News and Views

Super and Women

Women are continuing to retire with less superannuation than men. Lower average salaries than men and a period out of the workforce to raise children both contribute to this issue. This is not something that is easily fixed, but a greater awareness of the importance of looking after and contributing to your superannuation might help.

Some strategies to boost your super are:

- find and consolidate your super into one account

- take an interest in how your super is invested (it's your money!)

- make sure you are not paying more fees than necessary

- salary sacrifice - even just 2% more can make a big difference over the long term

- ask your spouse to split their super contributions with you if you are out of the workforce raising the family

- see if you can access the Government Co-Contribution

- if you are self employed and not receiving the Super Guarantee Contribution from an employer - consider making regular personal concessional (tax deductible) contributions.

Please talk to us if you would like to assess the value of any of these strategies for you.

Majella in the News

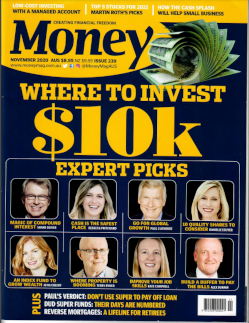

From time to time Majella Wealth gets mentioned in the news and Jo McCreery is a regular contributor to Money Magazine.

These links will open stories and news articles either about us or where we have made a contribution.

Money Magazine - Cover story - November 2020

Money Magazine - Cover story - August 2019

Money Magazine - Cover story - May 2019

Money Magazine - ask the experts - July 2018

Money Magazine - Super Guide 2017 - Smart Strategies

Money Magazine - Cover story - May 2017

Money Magazine - Cover story - June 2016

Money Magazine - ask the experts - October 2015

Money Magazine - ask the experts - May 2015

Money Magazine - ask the experts - November 2014

Money Magazine - Cover story- October 2014

Money Magazine - ask the experts - July 2014

Money Magazine - ask the experts - March 2014

Money Magazine - ask the experts - Feb 2014

Money Magazine - ask the experts - May 2013

Money Magazine - ask the experts - Sept 2012

Money Magazine - Cover Story - April 2012

Money Magazine - ask the experts - Feb 2012